In the evolving world of international supply chain, the demand for improved product visibility and source-to-store traceability has never been higher. Many brands and retailers operate trade networks that integrate hundreds of suppliers, logistics providers, and distribution channels with physical footprints spanning the globe. In addition

to the distributed nature of supply chain stakeholders, disparate information systems suffer constant communication issues between trade partners, which is largely due to outdated digital strategies and complex, home-grown systems.

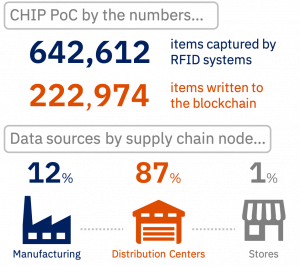

These assorted systems produce different dialects of data, creating more confusion than clarity when it comes to exchanging product information between trade partners. As legacy systems evolve and serialized systems like RFID are adopted, the retail industry as a whole generates exponential amounts of data. In fact, most supply chains today

are flooded with 50 times more data than they were just five years earlier, yet only a quarter of that data is utilized in a relevant timeframe (1).

Collectively, burdensome exchange practices and dissimilar data have inhibited the industry’s ability to leverage their growing Internet-of-Things (IoT) infrastructure and extract supply chain-wide insights. These isolated systems coupled with outdated exchange methods not only restrict visibility throughout the supply chain but also underpin fundamental business operations. Consequently, widespread inefficiencies and substantial costs propagate from one stakeholder to the next. As a result, billions of dollars are lost each year throughout the industry as retailers, brand owners, and logistics providers are plagued by problems like shrink, claims, and counterfeiting. These issues represent only a handful of the problems facing the global supply chain ecosystem, and the retail apparel industry as a whole is plagued with cost-consuming pain points that are consequences of deficient data exploitation.

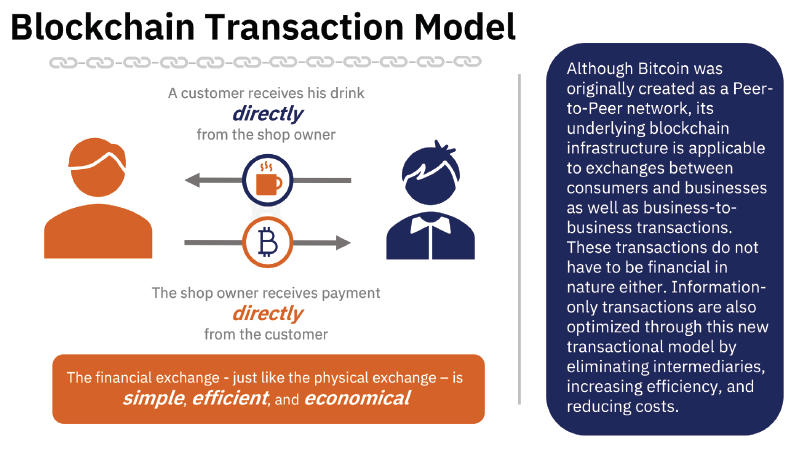

Enter blockchain, a transformative technology introduced by cryptocurrencies that holds the promise of alleviating today’s supply chain pain points. Blockchain technology enables a new type of business model driven by the collaboration between parties who work together to establish a trusted record of information that is maintained through mutual agreement, or “consensus.” The responsibility of governing this network and maintaining a collective record of truth is shared amongst network participants, eliminating the need for third parties to facilitate exchange or to act as trusted middlemen. By removing the need for outside entities to establish trust or vouch for integrity, those participating in a blockchain network are able to transact directly and more efficiently, as well as maintain ownership of their data. In the case of a trade network, all relevant stakeholders could share the responsibility of contributing and independently validating product information as goods flow through the supply chain, resulting in a mutually agreed-upon record of information available to relevant trade partners.

Given the current business landscape, there is tremendous application potential for blockchain technology to streamline exchange and cultivate collaboration between trade partners. The retail apparel industry is well-positioned to utilize blockchain, especially where IoT infrastructure and serialized data systems are already in place. Successful implementation of a blockchain-based solution for supply chain is dependent on each stakeholder’s

ability to identify products and capture information related to those products. Therefore, serialized systems, like RFID or other solutions that are capable of capturing item-level information, are the foundational data sources for a blockchain solution—the more granular the product information is, the more valuable the blockchain application can be. However, use of blockchain technology in retail apparel today is limited, given that insufficient exploration has yet to prove out the potential of this technology.

Download and read the full paper, Why Retail is Ready for Blockchain